Modi 3.0 union budget a disappointing start to Fintech funding in India; Kamala or Trump, Crypto can't decide; AI hype in Fintech funding continues;

Modi 3.0 union budget and its impact on Indian fintech funding, AI's continued hype in fintech investments, and Kamala Harris's potential influence on crypto. Stay on top of the latest fintech trends

I have been away for a long while (a month precisely). That is in partly due to a case of writers block, a part due to information fatigue, and a large chunk becuase I was not sure I was resonating with my audience anymore. So, I had to do a bit of mystery shopping (as well as move around my schedule), and find the mix that of what form and format I enjoy reading and writing the most.

So, the nex few weeks may be a bumpy one for me, but I promise to stay on track with all the fintech news from the world, in a fashion that doesn’t overwhelm others!

Starting with the budget and its impact on Fintech funding in India, how AI continues its funding hype cycle in fintech, what Kamala Harris could mean for Crypto and much more this week. So let us jump right in.

India

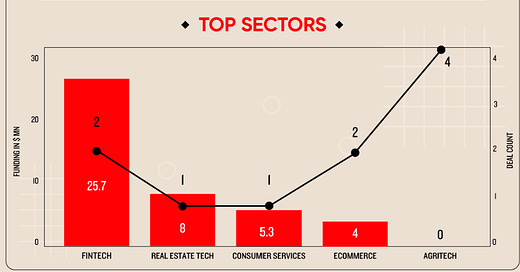

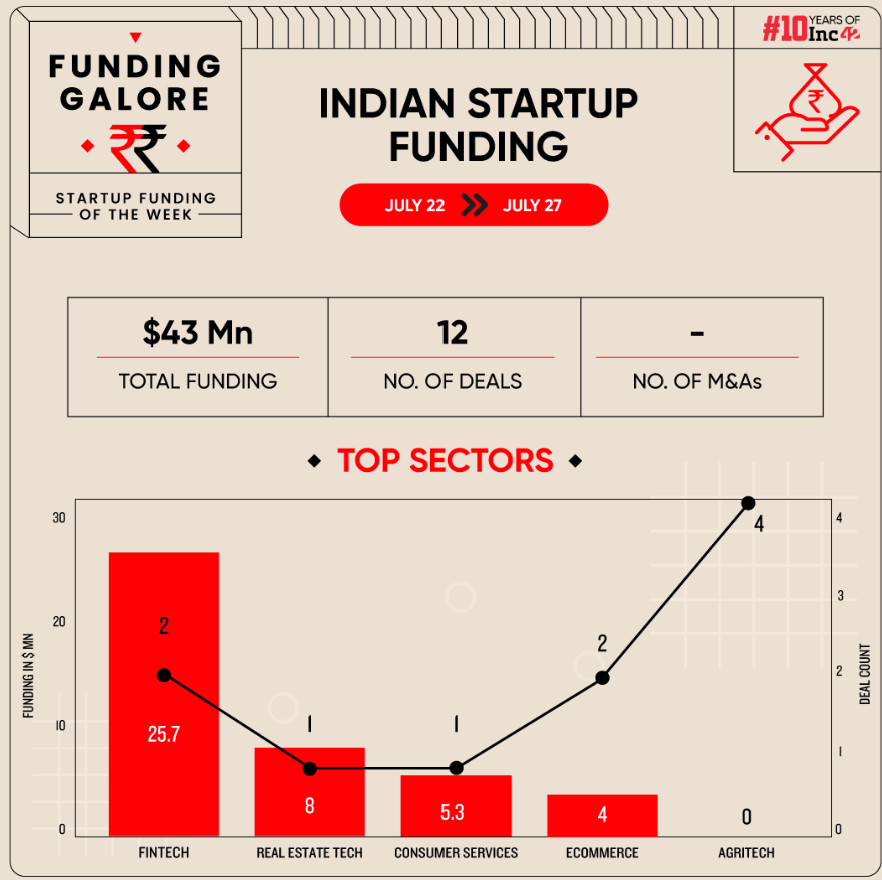

1. Funding seems have to slowed down, with a 365% drop from last week, to an all year low.

Between July 22 and July 27, Indian startups raised a meagre $43.1 Mn across 12 deals.

FAAD Capital emerged as the most active investor this week, backing four agritech startups with an infusion of over $121K. Call it the budget effect or what, this has to be the lowest that Indian fintech raised this year. Stable Money was the top of the chart, having raised $14.2 Million in Series A, from RTP Capital, Matrix Partner, Lightspeed Ventures.

Is this a temporary blip or a sign of a deeper malaise? Are investors tightening their purse strings, or are startups failing to make compelling pitches? And what does this mean for India's ambitious tech aspirations?

2. India's Fintech Revolution: A $420 Billion Juggernaut in the Making?

Ajay Kumar Choudhary, the big wig at the National Payments Corporation of India, has dropped a bombshell: the industry is set to explode from $110 billion in 2024 to a staggering $420 billion by 2029.And what is behind this 31% CAGR?

- favourble government policies

- a population that's more comfortable with smartphones than wallets,

- and an insatiable appetite for digital solutions.

it's a revolution in the making. Traditional financial services are being upended, with efficiency and innovation becoming the new currency.

But here's the million-dollar question: Can India's infrastructure keep pace with this breakneck growth? And more importantly, will this fintech boom truly democratize finance, or just create a new digital divide?

Key expectations included:

- Strengthening digital public infrastructure and security measures.

- Support for Bank Mitras through infrastructure grants and equity funds.

- GST exemptions on services offered through Business Correspondent outlets.

- Recognition of Self-Regulatory Organizations (SROs) in the fintech sector

Something don’t change much, such as the expectations of innovative fintech companies, which has stayed more or less the same, since the last 4 years. Question is can this Modi 3.0 deliver and live upto the segments expectations?

US:

1. Biden Bows Out, Bitcoin Buckles, and a Harris Memecoin Soars: The Wild Ride of Crypto Politics.

President Biden's sudden withdrawal from the 2024 race has sent ripples through the crypto world. As Biden passes the torch to VP Kamala Harris, Bitcoin took a 2.3% nosedive before stabilizing at $67,002. But here's where it gets interesting: a Harris-themed memecoin skyrocketed 131%, proving once again that in crypto, reality is often stranger than fiction.

Why the Bitcoin blues, though? Analyst Noelle Acheson suggests it's all about Trump's odds. With Harris potentially more likely to defeat Trump, the crypto community is bracing for a less favorable regulatory environment.

But Harris remains a crypto enigma. She's never officially commented on digital assets, yet her Silicon Valley ties hint at a tech-savvy approach. Could this be a new era for crypto regulation, or are we in for more uncertainty? Meanwhile, the surge in Harris memecoins raises eyebrows. Is this a sign of crypto's growing influence in politics, or just another example of market irrationality?

2. AI Agents to be the “Norm” in Regtech

AI continues its hype cycle, with Bain Capital Ventures, Blackstone Innovations Investments, New York Life Ventures, Citi Ventures, TIAA Ventures, and Jefferson River Capital, pouring in $27 million in seed fund to Norm.AI

What does Norm AI do?

ounded in 2023, Norm Ai has developed a groundbreaking AI platform that converts complex regulations into computer code. Imagine this: a team of AI and legal engineers creating a proprietary language to turn government regulations and corporate policies into decision trees. These trees then become executable programs, known as Regulatory AI Agents, which automate compliance analyses. The result? Faster, more accurate, and comprehensive compliance checks that can transform how businesses operate.

John Nay, Norm Ai's founder and CEO, has been at the intersection of AI and law for over a decade. He believes we’re at an inflection point where AI can massively improve regulatory compliance workflows. "To have the Series A backing of such notable institutions is a testament to Norm Ai's leadership in Regulatory AI," Nay says.

With this new funding, Norm Ai plans to expand its platform and grow its client base. They’re hiring across various roles, including software engineering, AI engineering, legal engineering, and sales.

3. FIS and Lendio Join Forces: A Game-Changer for SMB Lending or Just Another FinTech Promise?

global fintech giant FIS has unveiled its Digital Lending Solution. Partnering with Lendio, this cloud-native, API-driven SaaS offering aims to cut through the red tape that's long strangled small business funding.

With SMBs forming the backbone of the American economy—99.9% of businesses and 43.5% of GDP—this solution couldn't come at a more crucial time. But can it truly democratize lending in an era of sky-high interest rates and stringent regulations?

FIS claims its AI-powered platform will streamline everything from underwriting to funding, potentially making loans more affordable and accessible. But here's the million-dollar question: Will this tech-driven approach really level the playing field, or just create a new set of gatekeepers?

The promise of embedded analytics and pre-qualification features hints at a more proactive lending environment. But as banks salivate over potential revenue growth, will SMBs find themselves drowning in targeted offers?

UK and Europe: The resurgence of Neo-banking

1. Revolut's Long-Awaited UK Banking Licence: A Game-Changer or Just the Beginning?

After a nail-biting three-year wait, fintech darling Revolut has finally clinched a UK banking licence – but don't pop the champagne just yet. The Prudential Regulation Authority (PRA) has tossed them the keys, but with a catch: they're on training wheels for now.

Revolut's announcing they're in the "mobilisation stage," which is fancy talk for "we can only hold £50,000 in total customer deposits. Here's the really juicy part - once Revolut gets that full license, their customers' accounts will be protected by the UK's Financial Services Compensation Scheme. That's like having a safety net of up to £85,000 if things go south. For now, it's business as usual for UK customers – They'll be putting their systems through their paces and gradually rolling out new services.

But this begs the question: what's next? Will this restricted licence be the springboard Revolut needs to revolutionize British banking, or is it just another hurdle in their quest for financial domination?

Since 2021, Revolut's been eyeing this prize like a cat watching a fish bowl. Now that they've got their paws wet, will they make a splash or barely cause a ripple in the UK's banking pond?

2. UniCredit’s bold step into the future of embedded banking with Vodeno and Aion Bank

UniCredit just made a game-changing move by snapping up Vodeno and Aion Bank, and it's set to shake up the financial landscape in Europe.

Here's the scoop: UniCredit has signed a binding agreement to acquire the entire share capital of both Vodeno and Aion Bank. This isn't just any acquisition; it's a strategic leap forward. By combining Vodeno's scalable and flexible cloud-based platform with Aion’s European Central Bank (ECB) license, UniCredit is poised to offer a comprehensive Banking-as-a-Service (BaaS) solution. This means they can provide end-to-end banking services to both financial and non-financial companies across Europe.

What makes this so exciting? Aion and Vodeno have the tech to embed financial solutions—think accounts, deposits, lending, and payment services—directly into the customer journeys of retailers, e-commerce platforms, fintechs, and even traditional banks. Imagine seamless financial services integrated into your favorite shopping or banking apps. That's the future UniCredit is betting on.

The Vodeno Cloud Platform is particularly impressive. It's a cloud-native core banking system built with smart contracts technology and API-based integration, which means it's not just modern but also incredibly efficient and adaptable. This acquisition allows UniCredit to own next-gen core banking technology without relying on third-party providers. It's like they’ve bought the keys to a high-tech financial kingdom.

For UniCredit, this move significantly boosts their embedded finance proposition. They’re not just buying technology; they’re acquiring a team of expert technologists and developers who can innovate and adapt swiftly to market changes. This positions UniCredit at the cutting edge of financial services, ready to offer a comprehensive range of products for high-value segments.

3. Big Win for Modulr: FCA Lifts Onboarding Restrictions!

Here's the backstory: Last year, the UK's Financial Conduct Authority (FCA) hit the pause button on Modulr, stopping them from bringing on new agent and distributor (A&D) partners. But now, after some serious upgrades to their onboarding and oversight processes, Modulr is back in action.

Modulr shared the news with FinTech Futures, saying they've made significant enhancements and conducted extensive testing to ensure everything's shipshape. With these improvements in place, the FCA has given them the thumbs-up to start onboarding new A&D partners again. There's just one catch – Modulr has to give the FCA a heads-up at least 10 business days before bringing any new partner on board.

So, what does this mean for Modulr?

They can now expand their reach by enlisting new partners to issue electronic money on their behalf. This move will significantly boost their payment services, allowing businesses to integrate payments directly into their platforms without the hassle of building their own systems.

Modulr is taking their regulatory responsibilities seriously and plans to keep working closely with the FCA to maintain top-notch standards. This development is a testament to their commitment to compliance and quality.

4. From BNPL Pioneer to Strategic Seller: Klarna's $515 Million Checkout Gambit

Klarna, the Swedish fintech giant, is shaking up the payments landscape once again. In a bold move, it's offloading its Klarna Checkout (KCO) service to a consortium led by BLQ Invest's Kamjar Hajabdolahi for a cool $515 million. But what's really behind this high-stakes deal?

The sale, which includes a hefty revenue-sharing agreement, marks a strategic pivot for Klarna. By shedding KCO, the company sharpens its focus on flexible payment methods while potentially smoothing relationships with payment giants like Stripe and Adyen.

KCO, a Nordic e-commerce heavyweight with up to 40% market share in Sweden, will change hands on October 1st. But don't expect a clean break – Klarna and KCO will continue their tango under a distribution partnership.

5. A new digital-only bridging lender, Morpheus, launched in the UK, offering up to £750,000 in bridging loans with advanced tech features like digital KYC and biometric authentication.

Australia & New Zealand

1. CDR's Growing Pains: Time for a Rethink in Australian Open Banking

The Australian Banking Association (ABA) has just dropped some eye-opening findings from a strategic review of the Consumer Data Right (CDR) initiative, four years after it first launched.

The CDR, which kicked off in July 2020, was designed to let Aussie bank customers share their data securely and easily. But according to a review by Accenture, commissioned by the ABA, the initiative has fallen short of its lofty goals. ABA CEO Anna Bligh put it bluntly: “It has not fulfilled its potential.”By the end of 2023, a mere 0.31% of bank customers were using CDR, and over half of the data-sharing arrangements had either been discontinued or allowed to lapse. Despite the banks pouring around AUD 1.5 billion into making CDR a success, the return on investment has been underwhelming, especially for smaller banks.

Michael Lawrence, CEO of the Customer Owned Banking Association, highlighted that the initiative has actually made it tougher for smaller banks to compete. The high compliance costs are forcing these banks to make tough choices, often sidelining vital tech and customer projects.

Bligh pointed out that while Australians have eagerly adopted digital banking innovations like mobile wallets and PayID, the uptake of CDR has been disappointingly low. She suggests it’s time to go back to the drawing board, as the current CDR framework isn’t delivering for customers or boosting competition.

Lawrence echoed this sentiment, calling for a clear roadmap before smaller banks commit more resources. He warns that pushing forward without addressing the foundational issues will further erode competition and divert essential investment away from improving customer outcomes and supporting local communities.

2. How Dosh Aims to Revolutionize Banking in New Zealand

Founded in 2020 by James McEniery and Shane Marsh, Dosh started as a mobile payments app, quickly becoming New Zealand's first local mobile wallet. Since then, they've expanded their offerings to include personal loans, savings accounts, and their own Dosh Visa debit card. Now, they’re setting their sights even higher by applying for a banking license from the Reserve Bank of New Zealand.Why is this such a big deal? Well, if Dosh secures this license, they'll be able to hold customer funds directly, rather than relying on an AA-rated NZ registered bank to do so. This move could significantly enhance their service offerings and provide a more seamless experience for their users.

Announcing their intentions on LinkedIn, co-founder Shane Marsh said, “Our motivation in taking this step is we believe New Zealand consumers deserve competitive banking services that meet their needs. If successful, this application will make Dosh New Zealand’s first locally-owned, digital-only bank.”

Marsh emphasized that a digital-only service can create efficiencies for banking consumers, driving down costs and enhancing convenience. This is a significant step forward in a market where traditional banking has often lagged in innovation.

Despite the excitement, the journey won't be without its challenges. Dosh will need to meet stringent regulatory requirements, including a minimum $30 million capital threshold. Yet, Marsh is optimistic, noting that Dosh already meets most of the necessary criteria and is open to broader investor support to fulfill the remaining conditions.

Funding in the Fintech world

1. Global fintech investment took a nosedive in the first half of 2024, dropping a whopping 19% compared to the last six months of 2023. We're talking $15.9 billion invested worldwide, down from $19.5 billion. Ouch! But here's the kicker – this might actually be rock bottom, folks.

Now, before you start selling off your crypto, let's zoom in on the UK. Despite the global slump, the UK is still punching above its weight. They snagged $2 billion across 183 deals, making them the runner-up to the US in the fintech investment Olympics. Incidentally, did you know Paris might just be pulling off the world’s cheapest Olympics with a lot of flare?

Anyway, I digress.

But here's where it gets interesting. The fintech world is shifting gears, focusing more on the up-and-comers. We're seeing a trend towards earlier stage deals – think seed to Series B rounds. It's like the industry is planting seeds for the next big boom. In fact I spoke about it , here.

So, what's the takeaway? Sure, the numbers are down, but the game isn't over. It's just changing. The UK fintech scene is resilient, innovative, and poised for a comeback. Who knows? Today's seed funding could be tomorrow's unicorn.

2. Egypt-based fintech MNT-Halan raised $157.5 million in a funding round, with $40 million from the International Finance Corporation (IFC). The company is using the money in part to fund the acquisition of another fintech, Tam Finans, to expand into Turkey. Tam Finans provides financing to micro-enterprises and SMEs. It currently operates 39 branches in 26 cities across Turkey and claims to hold a 40% market share in the country.

3. AI maybe overhyped, but it sure is helping (partly) a lot of fintech raise money from investors. Like Canoe Intelligence, which raised $36 million in Series C, at triple its last valuations, on the back of an AI driven strategy.

Besides Goldman (despite their internal analysts warning of an AI oversaturation), two Fidelity-owned private equity shops, F-Prime Capital and Eight Roads, also joined in the round.