Rationalising Fintech Valuations, Rupay finding its footing, CRED getting into secured lending; Apple's WWDC fintech reveal

What do the experts who visited Money 20/20 have to say about Fintech valuations now? How will Indian FinTech sector fare under Modi 3.0? How many new payment aggregators are there in India now and how many more do we need? And what are some of the latest fintech jobs in market?

All this and more, before I head to iFX international, at Cyrpus, to talk about all things Fintech!

INDIA

1. The biggest news of the week (after the World Cup kick off), has to be that Modi Government gets a third term in the parliament. So lets start off with a brief look at the number

2. Can technology truly democratize finance for India's economic backbone, the MSME sector?

India's MSMEs, the unsung heroes contributing 29% to GDP and employing over 123 million people, are caught in a paradox: vital to the economy yet starved of financial oxygen. With a staggering Rs 25 trillion credit gap, these enterprises are gasping for funds. But here's where fintech enters the stage, not just as a supporting actor, but as a potential game-changer.

Imagine a world where your digital footprint becomes your credit score. That's the reality fintech is crafting. By leveraging alternative data sources—from GST filings to utility bills—these innovators are rewriting the rules of creditworthiness. It's not just about filling a gap; it's about reimagining the very concept of financial inclusion.

And let's talk numbers: digital lending is projected to hit Rs 47.4 lakh crore by 2026. That's not just growth; that's a financial revolution waiting to happen.

But fintech's ambitions don't stop at lending. It's orchestrating a symphony of digital payments, with UPI conducting over 10 billion transactions in a single month. This isn't just convenience; it's about bringing the unbanked into the fold of formal finance.

Moreover, with 72% of MSME payments now digital, fintech is painting a new portrait of business operations—one where real-time insights replace guesswork, and strategic decisions are data-driven.

3. And the country welcomes another Payment Aggregator into its mist of 30 currently operational licensed PA, Aurionpro Payment Solutions. There are another 24 apllicants whose applications are under process, and a total of 74 entities whose applications were returned, and hence cannot operate. Aurionpro Payments, a subsidiary of the technology solutions company Aurionpro said the payment aggregator license will help the company towards its long-term goal as a payment service provider.

Aurionpro Payments offers a bouquet of e-payment options catering to e-commerce and SME businesses. The parent company Aurionpro Solutions caters to the needs of banking, mobility, payments and government sectors for digital transformation.

The RBI in March 2022 had issued a framework for payment aggregators in India and mandated to secure a license for acquiring merchants and providing them with digital payment acceptance solutions. Payment aggregator offers a convenient route to accepting payments to help small businesses adapt to digital ways in a streamlined manner.

But the real question is, do we really have a need for 54 payment aggregators in the nation?

On one hand, we are country that is served by 400+ banks. But the top 3 take about 80% of the market.

I say, let the payment market go that way too.

4. Tide and Setu partner up to enhance the bill payment experience for SMEs: offering seamless, smooth and secure bill payments for small business owners.

5. Are the youth of India ready to tap their way throughshops? That is the bet NeoFinity is taking, with their lates launch of NeoZAP

More than just a payment tag, it's a lifestyle statement that speaks the language of its users - swift, secure, and seamlessly integrated into their daily lives.

Imagine stepping onto the metro, your NeoZAP in hand, effortlessly gliding through the turnstiles without fumbling for tokens. Or picture yourself at a bustling street food stall, a mere tap away from savoring your favorite chaat, all while keeping your bank details under wraps with the virtual card feature.

But NeoZAP's allure goes beyond just tap-and-pay. It's about understanding that for today's youth, every transaction is an opportunity for an experience. That's why they've woven in a rewards program that resonates with the interests of its target audience - think movie nights and premium subscriptions.

And in a world where security concerns often overshadow innovation, NeoZAP steps up with an 8-point security fortress and a groundbreaking move: transaction insurance, a first for prepaid cards in India.

Despite this good news, the cheer will not be long lasting. Why? Because transaction volumes still haven’t seen an uptick, with Visa and MasterCard still dominating that.

And in my humble opinion, given how much of UPI is low ticket items, I am not so sure the Average ticket sizes will go up much. Add to the mix, that for Credit on UPI, presumably, the merchants will have to bear the MDR, where they have been used to 0 charges on UPI.

7. Is the future of working capital finance in India being reshaped by the fusion of technology and inclusivity? CredAble's recent INR 30 Cr debt funding from SIDBI isn't just another financial headline; it's a narrative of transformation in India's MSME landscape. As one of Asia's leading working capital FinTechs, CredAble is painting a new picture of financial inclusion, one algorithm at a time.

Imagine an AI-powered platform that doesn't just lend money but tailors liquidity programs to the unique heartbeats of enterprises and their MSME suppliers. This isn't about transactions; it's about understanding the pulse of 3,50,000+ businesses globally and orchestrating more than USD 8 billion annually in working capital.

But CredAble's story goes beyond numbers. It's a tale of breaking barriers, especially for women-led enterprises. By dedicating INR 200 Cr and supporting over 50 women-led businesses in just 10 months, they're not just financing; they're fostering dreams and challenging the status quo.

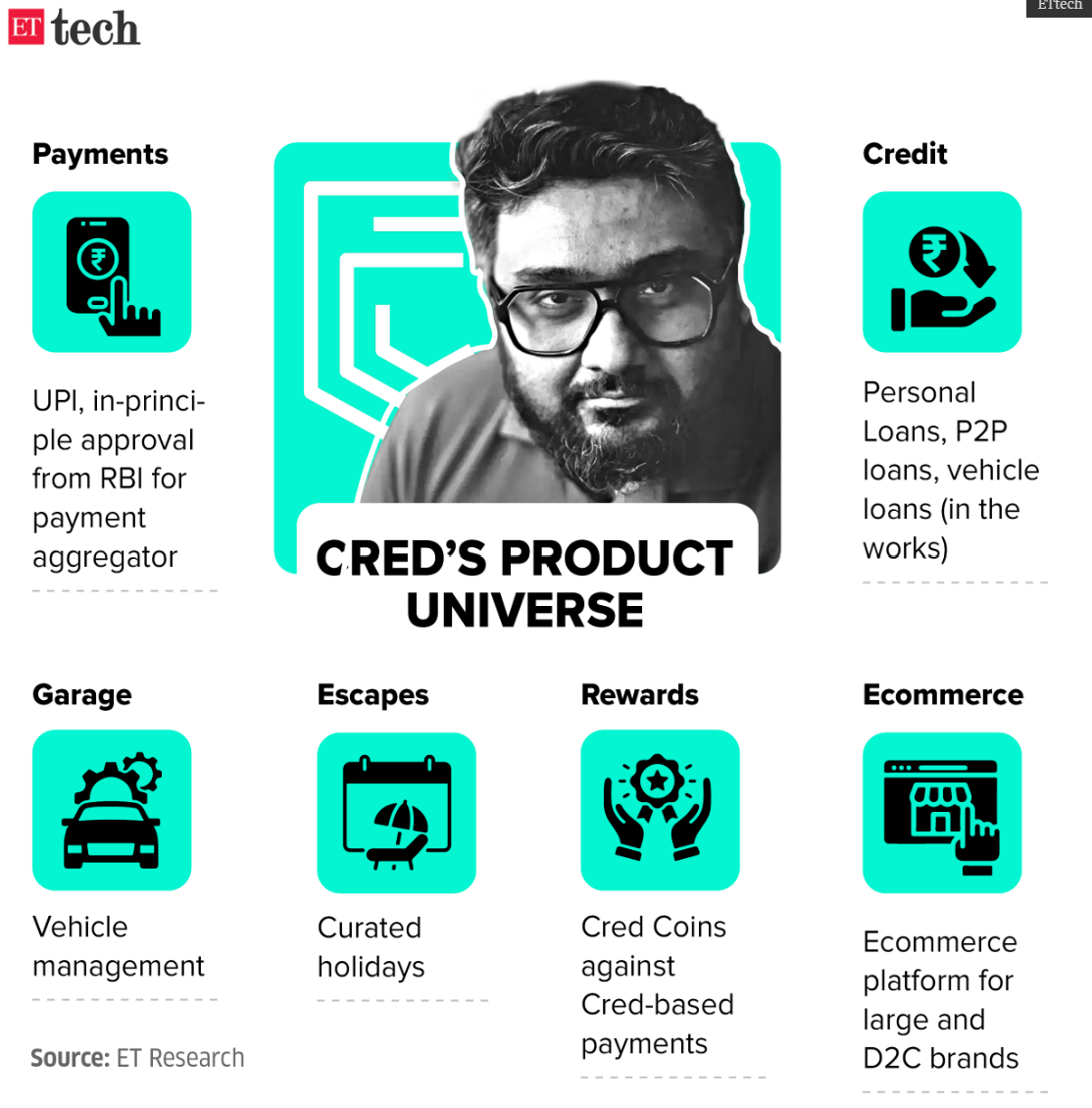

8. CRED is preparing to get into the secured lending business, a move I am sure not everyone gets, pun intended.

Since unsecured loans worked well for them, disbusing ₹1,800 crore to ₹2,000 crore a month and have a base of good credit history customers, they have now launched research into the potential of Secured loans for the platform.

But according to sources, CRED does not just want a button for sourcing these loans, they want to be able to control the entire user journey and experience with ssecured line of credit.

Now, given the lack of physical outlets for CRED, and how physically depended these loan categories are, that may be a wedge in this development. But that explains the CRED Garage foray doesn’t it?

I mean if CRED knows when you’d raise the next service request, it can very well figure out the rate of depreciation, in real time, and much more accurately than any other third party appraiser. Which would be immensely helpful when you wish to get a new car.

Asia

1. How has the digital revolution transformed the way Filipinos manage their finances, and what does this shift reveal about the changing landscape of personal lending?

In a recent study it was seen that, Filipinos spent a staggering 42 years collectively on digital lending apps in 2023, a 37% increase from the previous year. This isn't just a statistic; it's a testament to the growing reliance on digital financial services in a country rapidly embracing the fintech revolution.

The breakdown of this digital time investment is equally fascinating. Personal loan platforms claimed the lion's share at 63.4%, while point-of-sale loans, buy-now-pay-later services, and installment loans rounded out the mix. But beyond the numbers lies a deeper story of financial inclusion and changing consumer behavior.

With app downloads soaring by 52% and unique users jumping by 64%, we're witnessing a seismic shift in how Filipinos access credit. These apps, often just a tap away on smartphones, are democratizing lending, reaching individuals who might have been overlooked by traditional banking systems.

But this digital gold rush also raises thought-provoking questions. As Filipinos spend an average of 14 minutes per month navigating these digital lending landscapes, are we seeing the dawn of a more financially empowered society, or the rise of a new form of digital dependency?

2. Nium, a global leader in real-time cross-border payments, announced it has raised $50 million in a Series E funding round. A Southeast Asia-based sovereign wealth fund led this funding round and values the company at $1.4 billion post-money. The sovereign wealth fund joins other newly added investors from Nium’s previous funding round, including BOND, NewView Capital, and Tribe Capital.

The company will use this funding to accelerate its growth plans in the B2B payments market such as fueling global network expansion, accelerating product innovation, hiring top talent, and pursuing M&A activity.

Nium experienced strong revenue growth of over 50% last year compared to 2022.

US

1. WWDC 2024 had to be the most anticipated event of the year, where everyone waits for the nxt new revolution from Apple. (Although I must say after the iPhone the revolution really has been about consumer centric enhancements)

But this year, even the world of Fintech had something to celebrate. And no I am not referring to Apple Intelligence. Although I certainly love the spin given to it!

But rather it is Apple’s announcement of Tap to Cash, a much needed enhancement for the Apple Pay Wallets. Users can just bring their phones closer, and transfer money is in a secure, and private way without exposing any PII or personally identifiable information to the other party.

The other feature enhancement, came with their partnership with Discover, Synchrony, Citi and FiServ. Users can view and redeem rewards, and access installment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad.

2. CFPB is now fighting to remove medical debt from credit scores, in an attempt to become more consumer friendly.

3. Have you heard about Capital One's latest collaboration with the fintech giants Stripe and Adyen? It's a bold move that aims to create a data-sharing program aptly named "Direct Data Share," an open-source initiative that will revolutionize the authorization process, enabling secure transactions to happen at lightning speed.

But this isn't just any ordinary data exchange; it's a sophisticated system that allows merchants to send real-time transaction data, which is then shared among Capital One, Stripe, and Adyen. This collaborative effort empowers these financial powerhouses to spot fraudsters across their vast networks, ensuring that legitimate transactions are swiftly approved while suspicious activities are promptly identified and thwarted.

And the impact of this initiative is already staggering – according to Capital One, Direct Data Share has enabled a staggering $1 billion worth of transactions that would have been incorrectly declined under traditional systems. Imagine the countless businesses and consumers who have benefited from this seamless and secure financial ecosystem, their transactions flowing effortlessly through the digital veins of commerce.

But the thing is Direct Data share program has been live for at least a year now, with CapitalOne and Stripe, with the Adye Partnership being recerntly announce.

So why extend the partnership now? Well, the answer might just lie in Capital One's impending acquisition of the Discover network. While the Discover network has a relatively low acceptance rate compared to the titans of MasterCard and Visa, this partnership offers a compelling solution – by combatting payment fraud, an industry that costs consumers an eye-watering $10 billion annually in the United States alone, Capital One is poised to improve the odds of Discover's widespread acceptance.

It's a strategic move that resonates with the core values of the fintech revolution – innovation, security, and consumer empowerment. By harnessing the power of data sharing and leveraging the collective expertise of these industry giants, Capital One is not only positioning itself for future success but also paving the way for a more secure and efficient financial ecosystem.

4. What happens when the bridge between traditional banking and cutting-edge fintech collapses? The recent bankruptcy of Synapse, a fintech middleman, has exposed a startling $85 million discrepancy between partner bank holdings and depositor claims, leaving us to ponder the fragility of our modern financial ecosystem.

This revelation, unearthed by court-appointed trustee Jelena McWilliams, paints a troubling picture: while customers of fintech firms using Synapse believed they had $265 million in balances, the associated banks held only $180 million. It's a sobering reminder that even in our digital age, the age-old principles of trust and accountability remain paramount.

The plot thickens as McWilliams navigates the labyrinth of commingled funds across multiple institutions, her efforts hampered by a lack of resources and the absence of former Synapse employees. It's a race against time to reconcile the books and reunite customers with their hard-earned money.

As Judge Martin Barash weighs the options—from selective payouts to spreading the shortfall evenly—we're left to contemplate the true cost of financial innovation. Is the convenience worth the risk? And how can we ensure that the next generation of fintech doesn't repeat these costly mistakes?

In this unfolding drama, one thing is clear: the lessons learned from Synapse's downfall will shape the future of fintech regulation and customer protection. The question is, are we ready to heed those lessons?

UK and the rest of Europe

At the same time, the bank claims to have recorded a 50.6% revenue increase to £682.2 million, alongside a 4% rise in total deposits to £11 billion.

First tipping into the green in October 2020, Starling attributes its latest financial performance to “strong growth in revenue, deposits, active customers and customer transactions”.

“The percentage of active accounts now stands at nearly 80%, while total transactions rose by 21% to £174.1 billion during the year,” comments Starling group chair, David Sproul.

Founded in 2015, Bink was known for its Payment Linked Loyalty (PLL) technology, which linked the payment cards of its customers with the loyalty programmes of its partner brands.

British bank Barclays has maintained a “significant” minority stake investment in the company since 2019 and was accompanied by Lloyds Banking Group three years later.

Despite its backing, FRP Advisory told FinTech Futures this week that Bink had “suffered significant losses for a number of years and recent efforts to secure additional funding had proved unsuccessful”.

“The business had therefore ceased trading prior to the appointment of liquidators, with all 46 members of staff made redundant.”

3. Fintech valuations have come down from their unsustainable highs of 2020 and 2021. And this isn’t just my view, but what a lot of executives mentioned at the Money 20/20 events at Amsterdam. Value is now ascribed to businesses that manage to prove there is a solid use case, solid business model.

Fintech Jobs

1. Tech mahindra is looking for people with fintech experience in leading the digital transformation process for a large bank: https://www.linkedin.com/jobs/view/3939434478

2. PhonePe wants a Banking alliance head: https://www.linkedin.com/jobs/view/3799101750

3. First Abu Dhabi Bank is looking for people with Credit experience: https://www.linkedin.com/jobs/view/3840224862

4. I am looking for a tech lead to join us at LXME: https://www.linkedin.com/jobs/view/3948273630/